VIVA NETWORK – Revolutionizing Mortgage Financing

The Blockchain is a rapidly growing technology that is engulfing every possible business domain. Therefore, many reports published have predicted a huge rise in the Blockchain market. According to reports, the Blockchain market is expected to extend to over 20 billion dollars by 2024. It is counted in one of the most promising new technologies that are hoped to change the future of businesses and the internet.

You may be contemplating on the crypto coin that will be best for your investment. You might have even found yourself investing in one of these Cryptos but you did not gain your profit as you expected because, some developers, after hitting their target and making a huge sum of money, dropped the project, and left investors in the middle of no where. All hopes are not gone. Lets start a new page in you new or next journey to investment for profitable earnings. I will be introducing you to VIVA NETWORK which is a decentralized ecosystem that connects mortgage borrowers with global investors within a borderless, blockchain-secured cloud platform

Viva is a blockchain-based platform that will connect borrower and lender directly, thus eliminating the need for any intermediaries. Rather than going through the long process described above, users interested in lending money for their mortgage can essentially crowdfund their loans via the platform. One of the key advantages of the Viva platform is that this takes the power away from the established financial institutions so that interest rates are governed by the free market and not a few select institutions. By recording all transactions on the blockchain, all parties can rest assured that everything is kept in a secure, decentralized ecosystem.

Viva’s innovative technology uses Ethereum smart contracts to underwrite and securitize private home loans into Fractionalized Mortgage Shares (FMS) which can easily be bought and sold on the Viva FMS Exchange (a Secondary Market Exchange) application. Viva Network allows investors to crowdfund mortgages of home buyers from anywhere in the world, making the process quicker and easier for home buyers. With the ability to efficiently access the free market, both parties will now be able to capitalize on international interest rate arbitrage and obtain lower interest rate mortgages and higher returns on investments. Viva enables a free market to ascertain the interest rate on a borrower's mortgage and removes the dependence on banks and other financial intermediaries. By eliminating inefficiencies in local financial techniques, mortgage rates will more fairly and accurately reflect the level of danger related to the asset's actual value.

Viva’s goal is to free millions of borrowers located in regions with high interest rates from their reliance on inefficient local financial systems. The crowd lending transactions are conducted utilizing the newly released “ VIVA ” token, a blockchain-powered transfer vehicle, while the ultimate delivery of loans and mortgage repayments will be made in each party’s local fiat currency. Neither the borrower or the lender will require any knowledge of blockchain technology; they will need only use Viva Networks intuitive web platform. Importantly, neither party will be exposed to cryptocurrency fluctuation risk.

PROBLEM VIVA NETWORK IS PROVIDING SOLUTIONS TO

High interest rates for buyers, low interest rates for investors

Getting a mortgage is challenging and frustrating, and for many creditworthy individuals around the world - is often impossible. Furthermore, the profit model behind mortgage loans and Mortgage Backed Securities is one of the most lucrative business models in existence.

Despite this, banking corporations around the world consistently exploit consumers with price gouging, collusion and even interest rate manipulation. This centralised authority is irresponsible, and we believe these profits belong to the consumers - the homebuyers and investors - instead of the middlemen (the banks).

SOLUTION PROVIDED

Low interest rates for buyers, high interest rates for investors

Viva is a hybrid blockchain protocol that introduces a brand new option for consumers around the world to finance their homes - the free market.

Tearing down the decades-old barriers to entry in the securitization industry by introducing the world's first Peer to Peer Mortgage Financing Platform & Tokenized Mortgage Exchange.

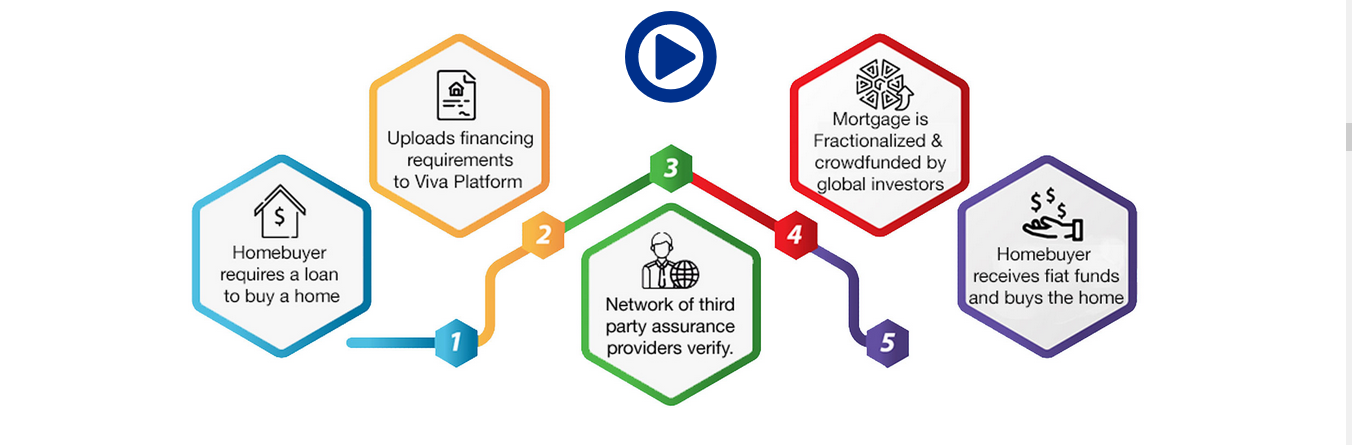

How Does Viva Work?

The platform is operated on a borderless and decentralized financing company for home loans that have been developed to eliminate the need to rely on middlemen like financial institutions and banks as well financial intermediaries. In order to create a brand new market in the mortgage industry, Viva will be used. The aim is to reduce the inefficiencies the industry has while making it more affordable to buy homes.

Private investors are permitted for the first time to buy high-end profitable, asset orient fractionalized mortgage shares. This also helps to innovate applications that have been designed to improve the current state and traditional credit scoring and appraisal procedures, often time outdated. The financial technology used in Viva is purposefully used to get larger decentralized loans to the people. The platform initiates smart contracts for use of funding home loans through crowdsales. And then it connects the investors with the borrowers p2p on the decentralized, trustless tech platform. The key to large transactions is strengthening the blockchain’s unbeatable security. Eliminating the middleman like Viva does, the loaning process becomes more profitable than ever before.

The company enables the free market to pick the going rate of interest a mortgage carries for the borrower. The need to have a bank or other financial service middleman is eliminated through the process and so are local financial institutions. Rates on the mortgage loans will naturally become fairer, reflecting the risk associated with it accurately in accordance with the assets true value. Viva started the process of decentralizing financial conglomerates power when the banks failed in 2008. Viva is now looking for ways to finish the process, thereby taking all power from the older, traditional and completely outdated financing systems – to leave them in the past, where they have belonged for a very long time.

Why Choose VIVA

· High transparency

· Decentralized

· Blockchain oriented

· Cloud scalability

· limitless

· Disruptive technology

· Smart

· Consists of innovative applications

The newly designed features are highly innovative. So they help the current and outdated property appraisal and credit scoring processes to improve. Viva and its new advanced technologies help reduce the global economic wealth disparity. This technology also increases the available credit for borrowers

TOKEN AND ICO DETAILS

The native currency of the Viva platform will be the VIVA tokens, which are based o the ERC20 tokens. As such, the Viva network supports Ether tokens as a method of payments. This means that users will use their Ether tokens to purchase VIVA tokens, which can then be used to make deals between borrowers and lenders. Users will naturally have to have access to an e-wallet in order to purchase VIVA tokens, as this is where they are stored.

Token: VIVA

Price: 1 ETH = 35,714 VIVA

Bonus: Available

Quantity: 3,000,000,000 VIVA

Platform: Ethereum

Accepting: ETH

Minimum investment: 0.001 ETH

Hard cap: 75,640 ETH

Country: Bermuda

Whitelist/KYC: KYC

Restricted areas: USA, China

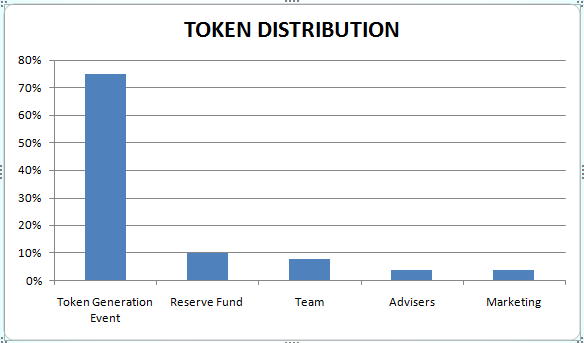

Token Distribution

ROADMAP

May 2016 - The beginning of the original idea.

June 2017 - Study of the ecosystem of chain links for the determination of relevant basic technologies.

July 2017 - Planning for the high-quality service-oriented architecture of the Viva platform.

August 2017 - Data analysis of geological exploration and feasibility study.

November 2017 - Development of the algorithm for estimating value 1.0.

Q1 & Q2 - 2018 - Token Generation events start and MVP development. Start a large-scale marketing campaign.

Q3 - 2018 - Development of Real Value 2.0 application. Obtain legal and regulatory licenses.

Q4 - 2018 - launches the Real Value 2.0 application. Completion of exclusive ML-algorithms.

Q1 - 2019 - to begin the gradual launch of the Viva network platform.

Q2 - 2019 - Launch the Viva Network platform and a successful first mortgage loan with a Viva mortgage loan system.

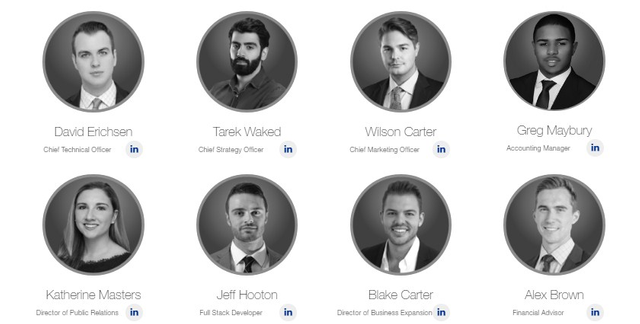

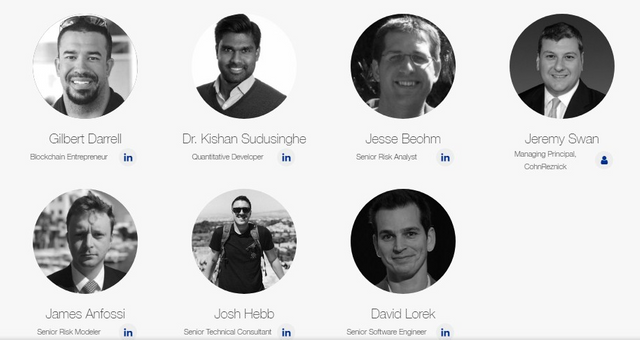

TEAM

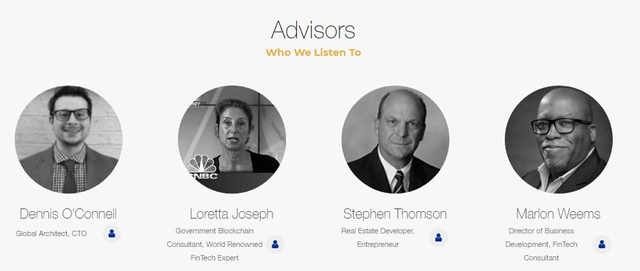

ADVISORS

FOR MORE INFORMATION PLEASE VISIT THE LINKS BELOW;

Web site: http://www.vivanetwork.org/

Whitepaper: http://www.vivanetwork.org/pdf/whitepaper.pdf

ANN Thread: https://bitcointalk.org/index.php?topic=3430485.0

Twitter: https://twitter.com/TheVivaNetwork

Facebook: https://www.facebook.com/VivaNetworkOfficial/

Medium: https://medium.com/@VivaNetwork

Telegram: http://t.me/Wearethevivanetwork

Bounty Thread: https://bitcointalk.org/index.php?topic=3602784

Author: BrainerdPaul

BitcoinTalk profile link: https://bitcointalk.org/index.php?action=profile;u=1680409